How Sales Tax Works on Cohart

Sales on Cohart can include Sales Tax in accordance with U.S. law. Here's a quick explanation for how it works.

What is Sales Tax?

Sales tax is a government-imposed tax on the sale of goods and services. In the U.S., it’s typically collected at the point of sale and varies by state, county, and city.

How is Sales Tax amount calculated on Cohart?

Sales tax is calculated automatically during checkout, using the latest tax rates across U.S. jurisdictions.

- Online sales or custom invoice with Ship option: Sales tax is automatically applied based on the sales tax rate of the buyer’s state/city (once shipping address has been filled).

- Online sales with Pick up option: Sales tax is automatically applied based on the seller’s state/city (if applicable).

- In-person sales (via Quick Sell) or custom invoice with Invoice Only: Sales tax is calculated based on the location at the point of sale. When checking out, the artist can toggle on “sales tax” and input the local tax by entering the area’s zipcode for a calculation.

The sales tax amount is added on top of the artwork price or order subtotal, and is shown clearly to the buyer at checkout.

The artist’s payout is based on the pre-tax price, and Cohart handles tax collection and remittance.

Example:

- If the order is $1,000 with a discount of $50, the subtotal would be $950

- The Sales Tax rate is set at 8.625% to be calculated based on $950, making the Sales Tax $81.9375 and rounded to $81.94

- The total (without shipping fee) will be $950 + $81.94 = $1,031.94

How Do I (the Seller) Set the Sales Tax Rate for Ship Sales?

For online sales or custom invoice with Ship option, the seller does not need to set a sales tax rate. Our system automatically calculates the sales tax amount based on the buyer’s address and zip code once they have filled it in.

How Do I (the Seller) Set the Sales Tax Rate for Pick up Sales?

For online sales with Pick up option, the seller can set the sales tax rate based on their state/city by following these steps:

- Navigate to the Edit Profile tab of your Dashboard.

- Toggle on

Sales Tax. - Enter the local zip code where you are selling from, to automatically calculate the Sales Tax rate (e.g. if you enter the LA zip code of 90230, the rate will show 10.25%).

- Alternatively, you can manually input a different Sales Tax rate (e.g. 15%).

If you set a Sales Tax rate from your Profile, it will become the default rate for all sales (excluding Ship sales) processed through Cohart. This rate will be applied when your buyer selects Pickup/Drop-off during the Buy Now checkout process, or when your buyer selects Invoice Only when paying for an invoice order.

How Do I (the Seller) Set the Sales Tax Rate for In-Person sales?

If you are completing an in-person sale (via invoice), the Sales Tax is calculated based on the location at the point of sale.

When creating an invoice for in-person sales, the seller can toggle on Sales Tax and input the local tax by entering the area’s zipcode for a calculation. If you forget, Cohart will simply deduct the Sales Tax from your sales price before sending your payout.

- Create an invoice or click on the Quick Sell button in App.

- Toggle on

Sales Tax. - If you have already set the default rate from your profile, it will be applied here.

- You can add or adjust the rate for that specific invoice as necessary.

If you set a Sales Tax rate from an invoice page, it will only be applied to that invoice and will not affect future invoices or online sales.

We recommend keeping a record of the tax collected for reporting purposes.

Managing Sales Tax Yourself

Cohart gives sellers the option to manage their own sales tax, instead of having Cohart collect and remit sales tax on their behalf.

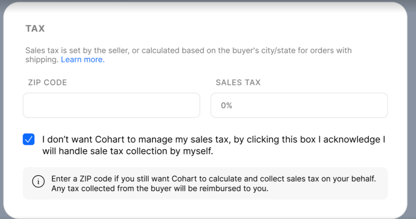

Opting Out of Cohart-Managed Sales Tax

When creating a sale or invoice, sellers will see the option:

“I don’t want Cohart to manage my sales tax.”

By selecting this option, you acknowledge that:

-

You are choosing to handle sales tax collection and reporting yourself.

-

Cohart will not refund sales tax if this option is selected.

Optional: Let Cohart Calculate the Tax (Without Managing It)

If you prefer to manage your own sales tax but still want help calculating the correct amount:

-

You may enter a zip code during checkout or invoice creation.

-

Cohart will calculate the applicable sales tax rate for that location.

-

The calculated tax can be shown to the buyer at checkout for transparency.

⚠️ Important: In this case, Cohart is providing a calculation only and will reimburse the amount in your payout. You remain fully responsible for collecting, reporting, and remitting sales tax to the appropriate tax authority.

Frequently Asked Questions

Who handles sales tax on Cohart?

If the sale is processed through Cohart’s platform, Cohart is responsible for collecting and remitting applicable sales tax. This ensures that artists don’t need to manage or remit sales tax themselves for any transactions processed by Cohart.

The buyer will see Sales Tax added at checkout, and the seller will receive the pre-tax artwork price / order subtotal (excluding sales tax and any applied discounts).

What about local or in-person sales?

If you're selling in person and using Cohart Tap to Pay, Cohart is still processing the payment, so we handle the tax for you.

However, if you are accepting direct payments outside of Cohart (e.g., cash, Venmo, personal card readers), then you are responsible for collecting and remitting any applicable sales tax to your local or state tax authority. Here's a list of available payment methods at Cohart.

For example, in California, in-person sales may require the artist to register with the CDTFA and remit the appropriate sales tax based on location.

Does Cohart provide tax documentation?

You don’t need to send separate invoices to buyers for transactions processed through Cohart. If you need documentation for your records (e.g. for VAT or income tax reporting), you can download your transaction history or generate an invoice addressed to Cohart.

We recommend consulting a tax advisor for reporting obligations based on your country and business setup.

What if I don’t set the sales tax rate in my Profile for online Pick up sales?

If you don’t set a Sales Tax rate in your Profile for Online Pick-up sales, the rate will then be calculated based on the buyer’s location. At checkout, the buyer can enter their zipcode, or the zipcode of the location at the point of sale. The system automatically identifies the zipcode and the correct sales tax rate, and adds tax calculation to the order summary.